Top Management Interview

June 2025,

Taro Hashimoto, CEO

We express our heartfelt gratitude for your continued support.

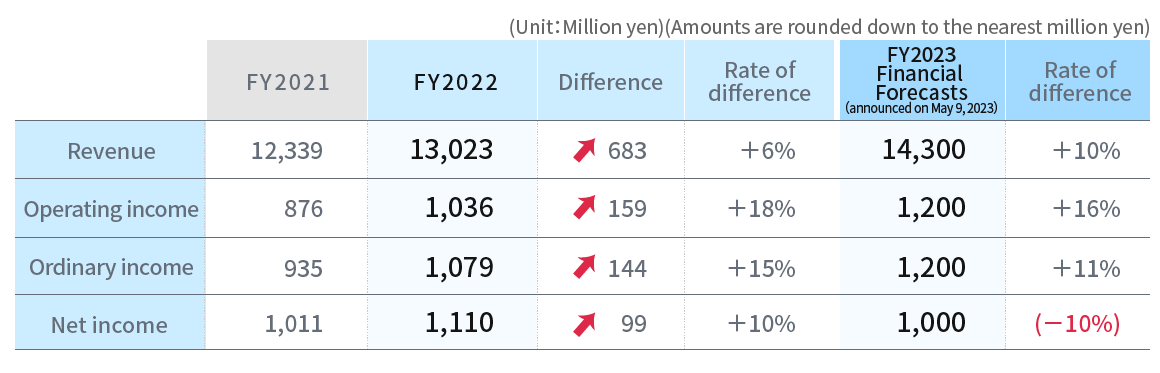

In the 2024 fiscal year, our performance showed that while the existing businesses in Education and Technology continued to perform well, both div inc. and divx inc. contributed to revenue growth but also put downward pressure on profits, resulting in an overall increase in revenue coupled with a decrease in profit. Additionally, net income significantly declined due to the recognition of extraordinary losses related to the divestiture of the Media Content business and impairment of assets in Studio & Production.

We sincerely apologize for the shift from our initial profit growth forecast to a decline in profits for the fiscal year 2024. We will reflect sincerely on the areas that require improvement and strive for a strong recovery in fiscal 2025.

For the 2025 fiscal year, we forecast an increase in both revenue and profit. We anticipate revenue growth across all segments. In terms of profitability, while the existing business in Education is expected to maintain levels similar to the previous year due to upfront costs associated with the opening of new schools, Studio & Production is projected to recover orders and achieve profitability. Broadcast is also expected to show a slight increase in profit. Furthermore, we expect the existing business in Technology to continue performing well. Notably, we anticipate a significant reduction in losses for div inc. (Education) and an expected net profit for divx inc. (Technology) for the entire fiscal year.

We are committed to "growing through sustainable and ethical businesses," in addition to aiming for "further expansion and higher profitability" (consolidated operating profit ratio of 10% and ROE of 30%). We believe that we can achieve this by transforming into a company primarily focused on Education and Technology.

To that end, we are currently exploring strategic options for Broadcast and Studio & Production. Depending on the outcomes of these strategic discussions, the revenue forecast for fiscal year 2025 may undergo significant changes in the future.

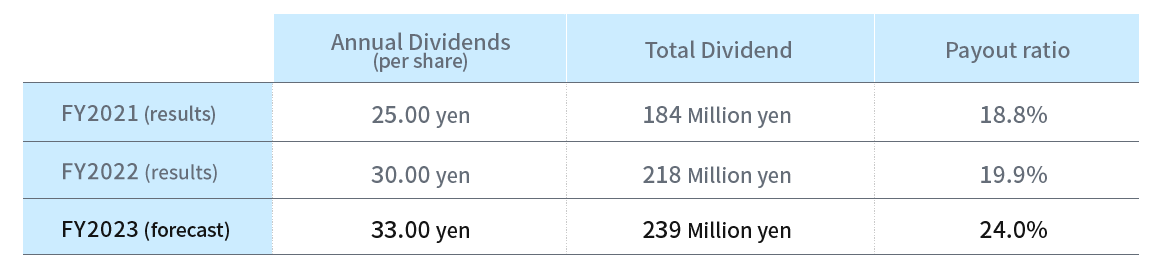

For the fiscal year 2024, we had previously announced a dividend of 40 yen per share; however, after considering our future financial situation comprehensively, we have determined that it is feasible to implement a more proactive shareholder return. Therefore, we have decided to increase the dividend to 50 yen per share. While we will continue to implement shareholder returns, we will also balance this with the necessary investments for ongoing growth.

In order to enhance corporate governance through the strengthening of the Board of Directors' supervisory functions, The Company has transitioned to a company with an Audit & Supervisory Committee starting in the fiscal year 2024. With the approval at this upcoming shareholders' meeting, the composition of the Board of Directors will include a majority of independent Outside Directors, and we intend to maintain this structure moving forward. Additionally, in July 2025, we plan to establish a voluntary Nominating and Compensation Committee as well as a voluntary Strategic Review Committee. These measures aim to ensure the transparency of management and the objectivity of oversight, ultimately striving for further enhancement of corporate value.

We would be most grateful to our shareholders for their continuing support.