Top Management Interview

December 2025,

Taro Hashimoto, CEO

We express our heartfelt gratitude for your continued support.

In the first half of fiscal year 2025, our performance was characterized by increased revenue and profit in Technology, while Education experienced both a decline in revenue and profit.

As a result, on a consolidated basis, revenue decreased while profits increased compared to the same period of the previous year.

This decrease in revenue ーby approximately 4% year-over-yearー was partly due to the transfer of our Media Content business conducted in the 3rd quarter of the previous year.

However, operating income increased substantially by 33%, ordinary income by 41%, and net income demonstrated a significant rebound with an increase of 638%.

This sharp improvement in net income is attributable not only to the tax-saving effect resulting from inclusion of div inc. and divx inc. in the consolidated tax group, but also to the absence of the extraordinary loss associated with last year’s business transfer.

As for the full-year forecast, we will maintain our outlook unchanged, as our business performance tends to be stronger in the second half compared to the first half, among other factors.

There are three main characteristics of our results for the first half. Firstly, despite the challenges faced by our Education segment due to environmental changes in the online high school business, declines in profit were largely offset by other businesses such as Japanese language education and div’s AI and programming education businesses. Secondly, within Technology, our existing Akamai services continued to perform steadily, and divx, which drives development utilizing AI, has turned profitable, thereby supporting overall profit growth in this segment. Thirdly, while div and divx had a negative impact on our financial results up to the previous year, both have begun focusing on AI-related education and development this fiscal year. As a result, we are seeing a notable improvement in profitability driven by increased revenue and greater operational efficiency, along with the continued benefits of implementing fundamental cost reductions since the previous fiscal year.

Furthermore, as part of our business portfolio review, we resolved to transfer the Japanese subtitle and dubbing production business, which is currently conducted by the Studio & Production Group, to Broadmedia Studios Corporation, a new company to be established, as of the scheduled effective date of April 1, 2026. This decision was made to enhance our organizational flexibility and better position us to pursue strategic options. We continue to assess strategic options for several of our existing businesses.

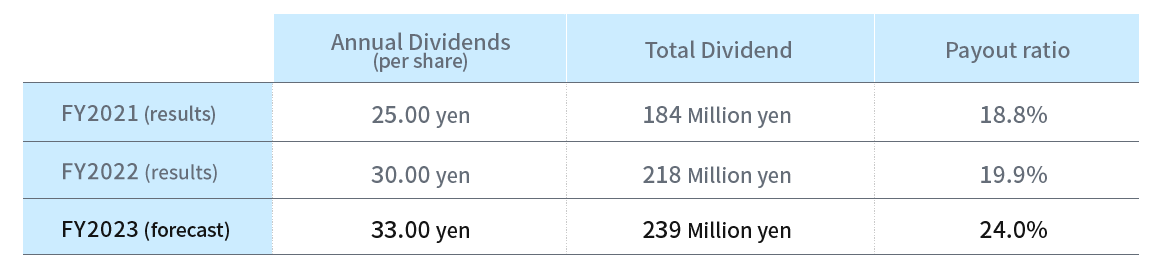

As for the year-end dividend for FY2025, we plan to pay 50 yen per share. We will continue to deliver shareholder returns, while considering the balance with investments necessary for growth.

The Company is committed to establishing a unique, integrated educational business combining Education & Technology, now further enhanced with AI-related education and development utilizing AI. All of us at the Broadmedia Group will continue working as one toward this goal throughout the second half of the year.

We are most grateful to our shareholders for their continuing support and encouragement.