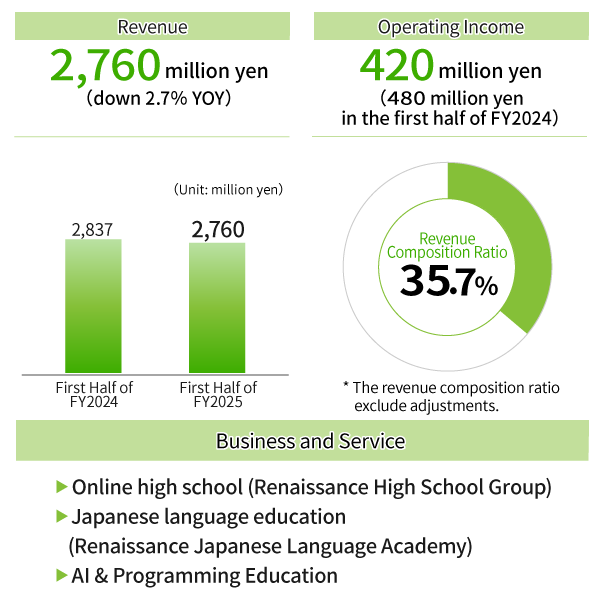

- Revenue and profit decreased across the Education segment.

- The number of students enrolled in our online high schools has been increasing steadily at Osaka campus, while Daigo campus continues to face challenges, resulting in a decline in revenue.

- An increase in costs, including higher labor expenses and enhanced promotional activities, also contributed to the decline in profit.

- The number of students in the on-campus courses, including the eSports course, remained almost unchanged from the same period of the previous year.

- We will continue to address challenges such as the establishment of a new school and increasing enrollment capacity in order to achieve further growth.

- In Japanese Language Education, enrollment in the Japanese language teacher training course increased, resulting in higher revenue and a return to profitability.

- Although revenue at div inc. declined, losses were reduced by approximately 100 million yen through substantial reductions in fixed costs, including a review of high customer acquisition expenses, organizational restructuring, and downsizing of office space. Performance is showing signs of improvement as the business shifts toward AI education and expands corporate training services. Looking ahead, we aim to achieve profitability in the next fiscal year and pursue even greater growth.

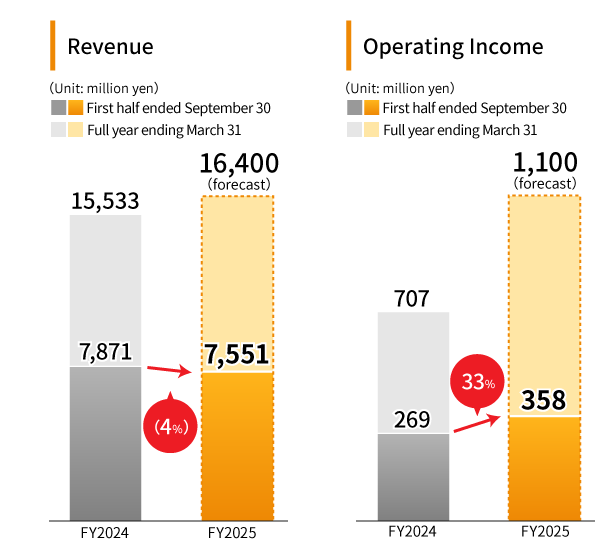

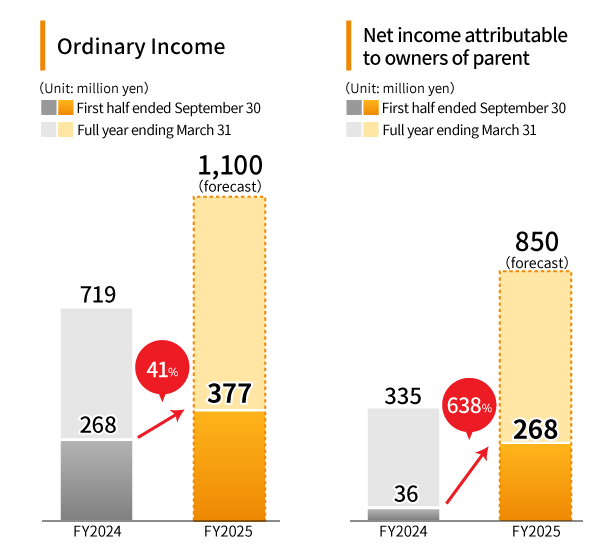

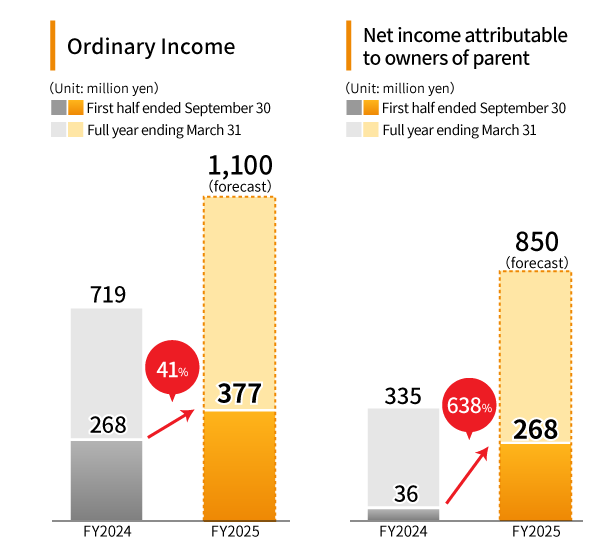

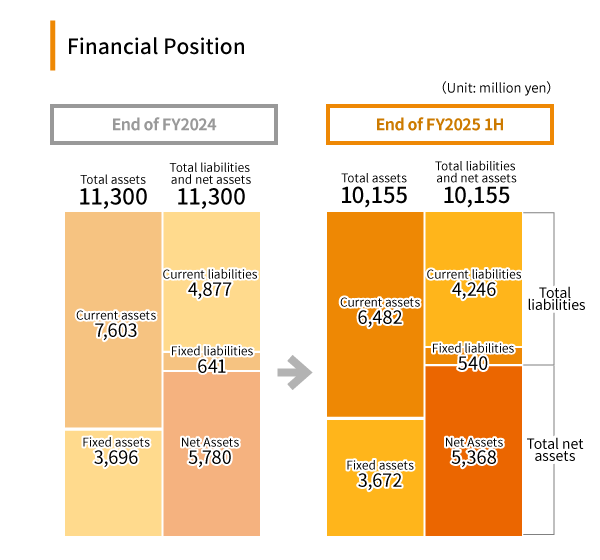

For the First Half of FY2025

Financial Highlights (Consolidated)

Financial Results : Key Points

1. |

Overall, compared to the same period of the previous year, the Company recorded lower revenue but higher operating income. While Technology posted both increased revenue and profit, Education, Broadcast and Others experienced a decrease in both revenue and profit. The transfer of the Media Content business in the previous fiscal year resulted in lower revenue but improved profitability in the current fiscal year. |

|---|---|

2. |

Net income increased due to factors such as the tax-saving effects from including div inc. and divx inc. in the consolidated tax group, as well as the absence of extraordinary loss due to the transfer of the Media Content business that was recorded in the same period of the previous fiscal year, among others. |

3. |

Performance in the first half was generally in line with expectations, and full-year forecasts remain unchanged. |

1. |

Overall, compared to the same period of the previous year, the Company recorded lower revenue but higher operating income. While Technology posted both increased revenue and profit, Education, Broadcast and Others experienced a decrease in both revenue and profit. The transfer of the Media Content business in the previous fiscal year resulted in lower revenue but improved profitability in the current fiscal year. |

|---|---|

2. |

Net income increased due to factors such as the tax-saving effects from including div inc. and divx inc. in the consolidated tax group, as well as the absence of extraordinary loss due to the transfer of the Media Content business that was recorded in the same period of the previous fiscal year, among others. |

3. |

Performance in the first half was generally in line with expectations, and full-year forecasts remain unchanged. |

Financial Results by Segment

(Year-over-Year)

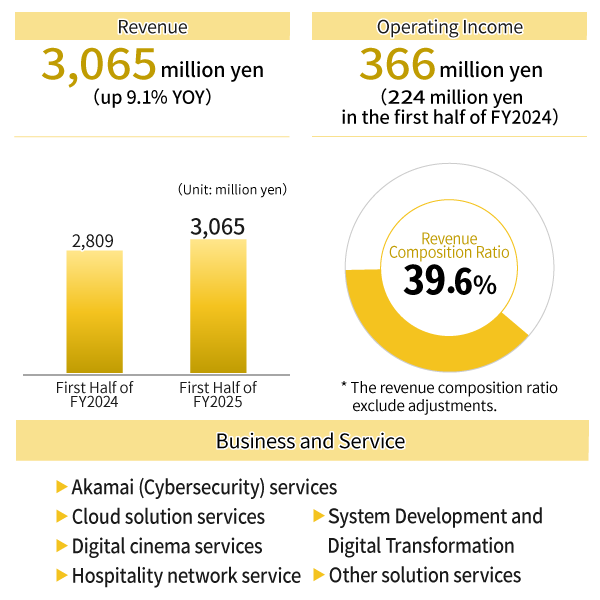

- The Technology segment as a whole achieved increased revenue and profit.

- Our flagship Akamai (cybersecurity) service increased both income and profit.

- System Design Development Co., Ltd., a subsidiary of the Company, increased its revenue and reduced its losses.

- Contributing to digital transformation (DT) and security measures of each business within the Group

- Revenue at divx inc. increased. Profitability improved significantly—by 91 million yen—as a result of cost reductions, including optimizing personnel such as engineers, and the company achieved profitability. divx inc. is also driving greater development efficiency by leveraging AI.

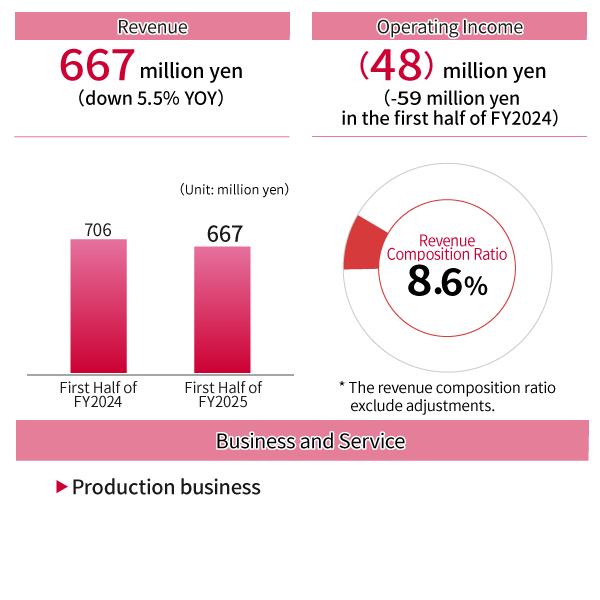

- The Studio & Production segment experienced a decrease in revenue but a reduction in losses.

- Although subtitle production performed well, revenue declined due to a decrease in orders for audio production.

- On the other hand, losses were reduced due to the cost reductions resulting from the impairment process conducted in the previous fiscal year.

- In the medium term, we will strive to increase added value through business process improvement and the utilization of AI.

- We have resolved to transfer the business to Broadmedia Studios Corporation, a new company to be established, with the scheduled effective date of April 1, 2026.

- The Company continues to consider its options strategically.

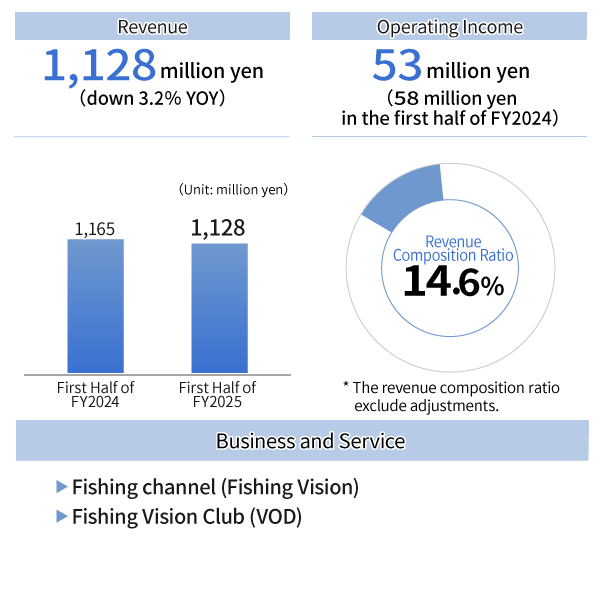

- Revenue and profit decreased across the Broadcast segment.

- Subscription fee revenue continues to fall.

- Although advertising revenue and sales from Fishing Vision Club (VOD) increased, overall revenue slightly decreased.

- Operating income decreased due to an increase in production costs associated with program production, among other factors.

- The Company continues to consider its options strategically.

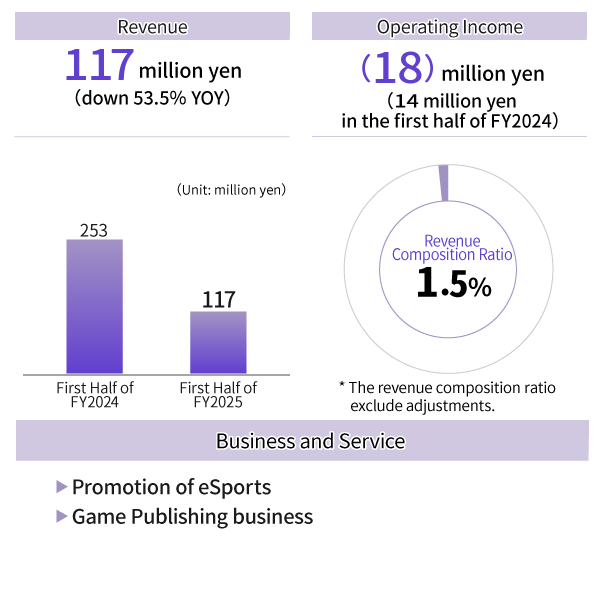

- The Others segment as a whole recorded a decrease in revenue and posted a loss.

- The Game Publishing business recorded a significant decline in revenue and losses due to the absence of major contracted development projects.

- Promotion of eSports recorded revenue and operating losses at the same level as the same period of the previous year.

Please refer to the “Summary of Financial Results for the First Half of the Fiscal Year Ending March 31, 2026 ” for details.