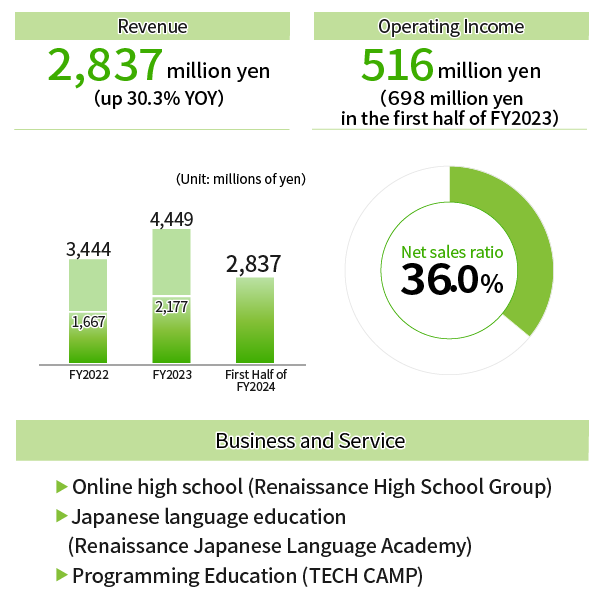

- Online high school business increased in both revenue and income.

- The number of online high school students enrolled in the on-campus courses, including the eSports courses, increased and reached a record high.

- Measures will continue to be taken to address issues attributable to rapid growth such as the securing of teachers, increase of enrollment limits, etc.

- Enrollment in the Japanese language teacher training courses increased.

- Div Inc. posted an operating loss pushing the segment income down by 210 million yen. In the second quarter (July to September), revenue decreased compared to the previous quarter (April to June), but the deficit was reduced due to cost containment measures.

- Div expects losses to affect the Group in the short term. Efforts will be made to improve profitability with an eye toward achieving more robust growth.

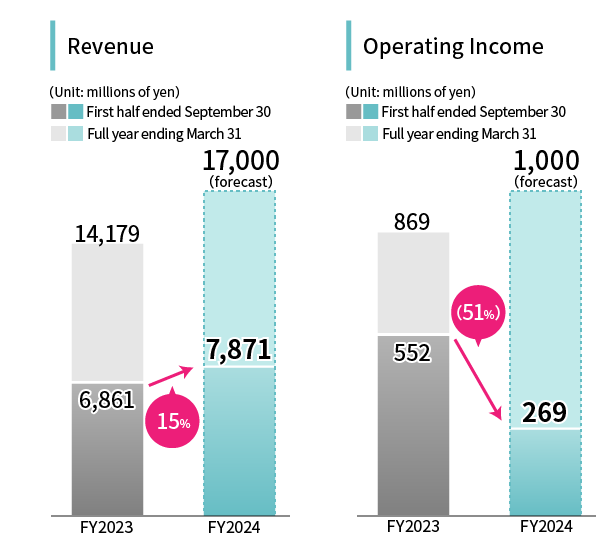

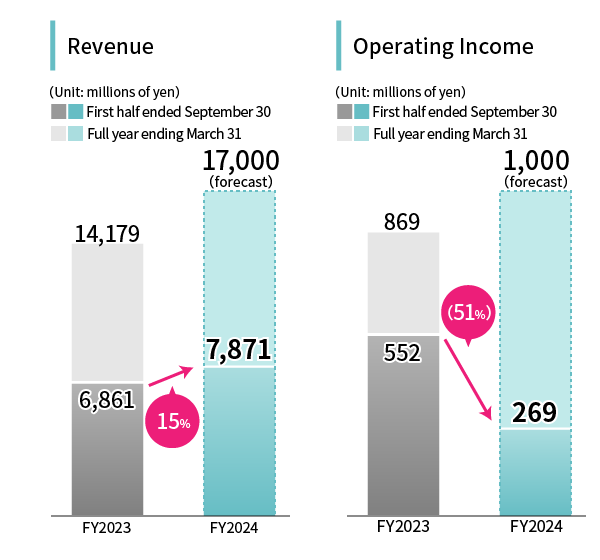

For the First Half of FY2024

Financial Highlights (Consolidated)

Financial Results : Key Points

1. |

Education, Technology, and Others performed steadily. On the other hand, revenue increased but income decreased Year over Year due to the impact of an operating loss (incl. goodwill) at div Inc. (education) / divx Inc. (technology), which became a subsidiary. |

|---|---|

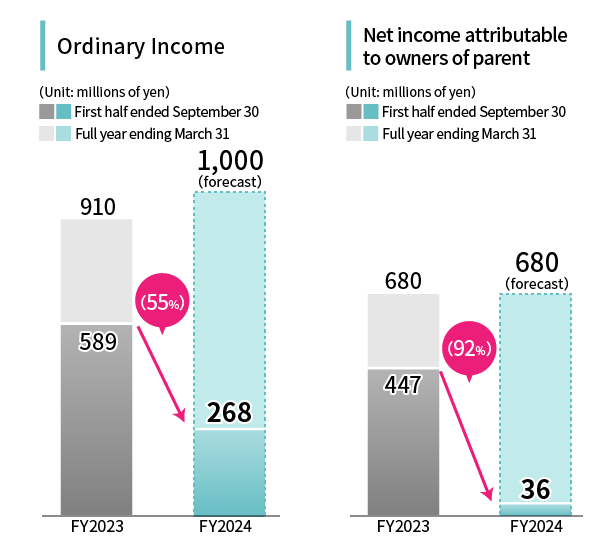

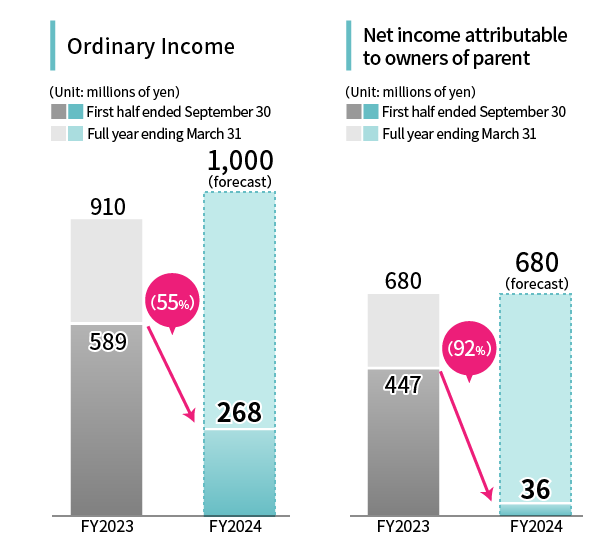

2. |

Net income declined significantly due to extraordinary losses related to the business transfer of the Media Content business, and the direct impact of losses at div Inc. and divx Inc. |

3. |

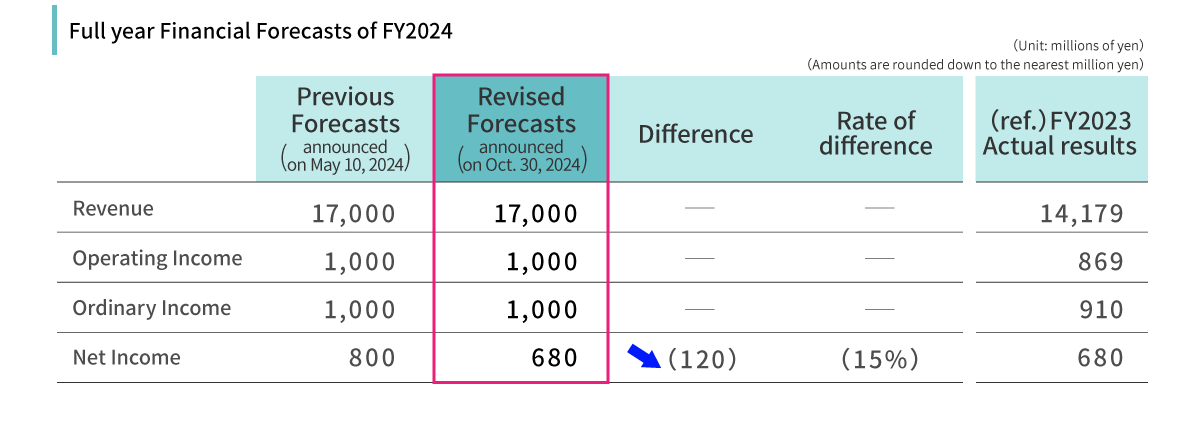

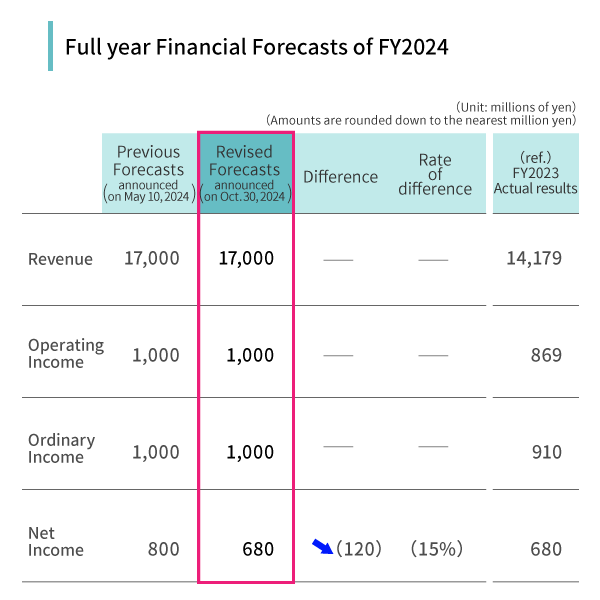

Full-year forecast for net income was revised downward due to the impact of 2 above. |

1. |

Education, Technology, and Others performed steadily. On the other hand, revenue increased but income decreased Year over Year due to the impact of an operating loss (incl. goodwill) at div Inc. (education) / divx Inc. (technology), which became a subsidiary. |

|---|---|

2. |

Net income declined significantly due to extraordinary losses related to the business transfer of the Media Content business, and the direct impact of losses at div Inc. and divx Inc. |

3. |

Full-year forecast for net income was revised downward due to the impact of 2 above. |

Financial Results by Segment

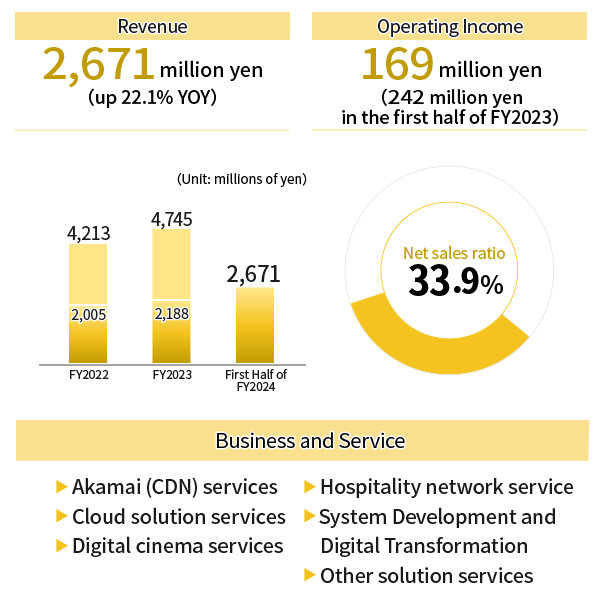

- Our flagship Akamai (CDN) service increased income and profit.

- Costs were higher with System Design Development, resulting in a loss.

- Divx Inc. posted an operating loss pushing segment income down by 107 million yen. In the second quarter (July to September), revenue decreased compared to the previous quarter (April to June), but the deficit was reduced due to cost containment measures. We aim to achieve profitability quickly.

- The G-cluster cloud game service will cease operations in February 2025.

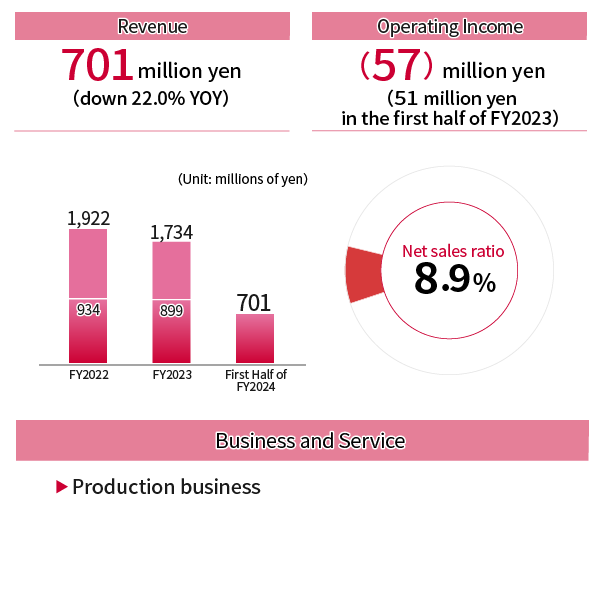

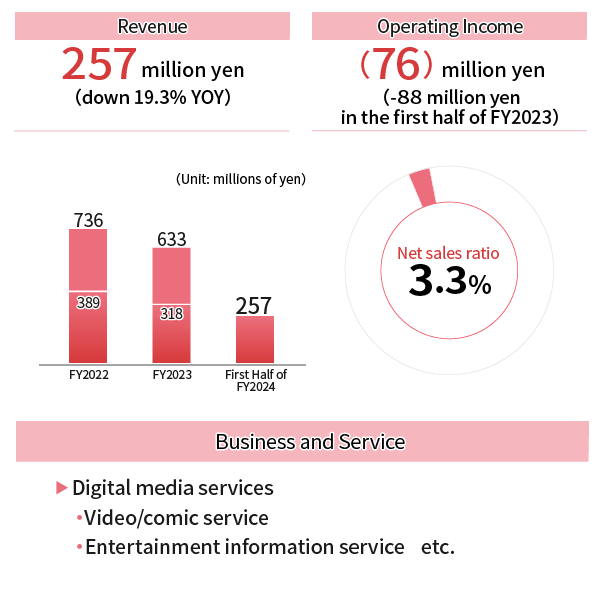

- The impact of the Hollywood strike continues, with income and expenditures significantly worsening due to a decline in sales. A loss was recorded.

- Order levels recovered in the second half of the year, with a full-year profit expected.

- Our medium-term goal is to provide high-value-added products and services through operational improvements and the use of AI.

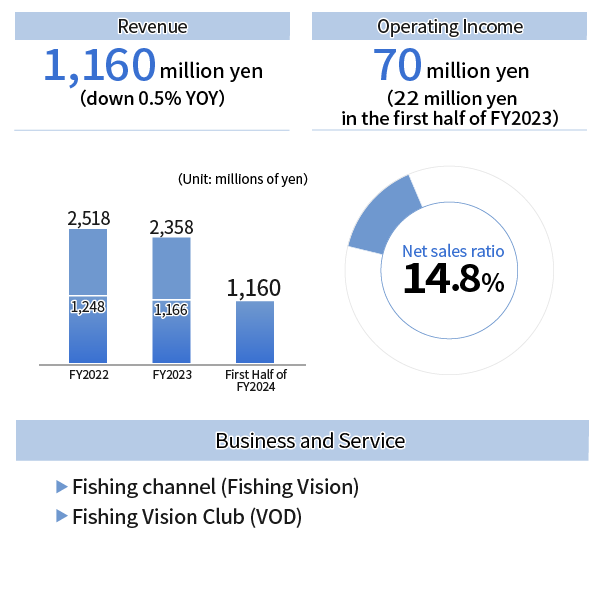

- Subscription fee revenue continues to fall.

- Sponsor revenue and sales from Fishing Vision Club (VOD) increased, maintaining revenue at a level similar to the same period in the previous year.

- Operating income increased due to the effect of cost control.

- The Company continues to consider its options strategically.

- The decision to transfer the video / comic service business and the entertainment news and information service was made after considering strategic options.

- Content license fees were recorded as extraordinary losses due to the transfer of the video / comic service business.

- All operations within this segment will be concluded in the third quarter.

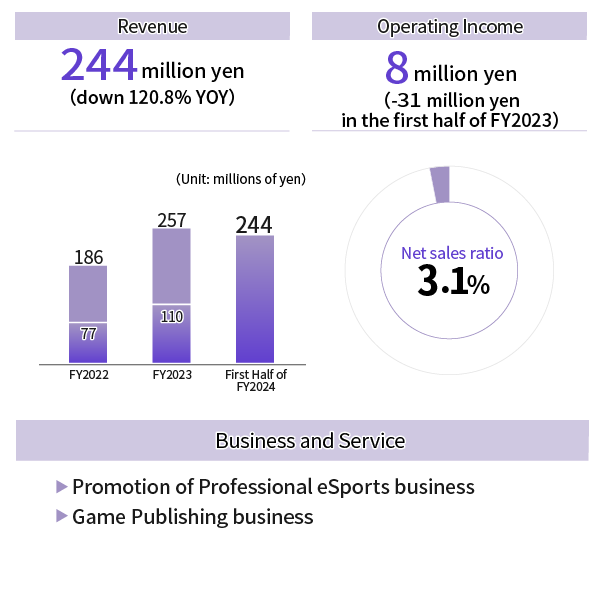

- The Game Publishing business saw a significant increase in revenue and returned to profitability due to a commission for a large-scale development project and new releases in the first quarter.

- Promotion of Professional eSports recorded at the same level as the same period of the previous year.

Please refer to the “Summary of Financial Results for the First Half of the Fiscal Year Ending March 31, 2025 ” for details.